Colite Technologies strives to help business owners understand and leverage the many benefits of solar energy, including available incentive programs that make solar more accessible. One of these programs is REAP by the United States Department of Agriculture (USDA), created for agricultural producers, such as farmers and ranchers, and small businesses in rural areas. We worked with one of our customers in Montana to apply for and receive a grant through REAP for their 23.7 kW rooftop solar system – here is how we did it.

What is REAP?

The Rural Energy for America Program (REAP) offers guaranteed loan financing and grant funding to agricultural producers and rural small businesses to install renewable energy systems or to make energy efficiency improvements. It encourages greater private sector supply of renewable energy which increases energy independence and decreases overall energy demand in the US. On a more local level, the loans and grants can make a huge impact on the financial viability of a project and can be the deciding factor on whether a person moves forward with a renewable energy project or not. There are three options for funding through REAP:

- Loan guarantees on loans up to 75% of total eligible project costs

- Grants for up to 50% of total eligible project costs

- Combined grant and loan guarantee funding up to 75% of total eligible project costs

Our case study will take us through the process of a REAP grant for a small business customer installing a renewable energy system in Montana.

Recent Updates to REAP

The REAP program is going through some changes due to an infusion of funds from the Inflation Reduction Act. Here are some of the recent changes.

- The application periods have been increased from two per year to four per year.

- For the remainder of the 2023 and 2024 fiscal year, there will be six quarterly application periods to obligate $1.05 billion.

- The maximum grant size has been increased from $250,000 to $500,000 for energy efficiency projects and from $500,000 to $1 million for renewable energy systems.

- The federal share was raised to 50% for all energy efficiency projects, all zero-emission renewable energy projects, and all projects in designated energy communities and projects submitted by eligible tribal entities.

- The creation of an Underutilized Technology Fund with an initial infusion of $144.5 million for renewable energy technologies which made up less than 20% of the project pool two years previous to the application year. No single technology may receive more than 50% of the total funding avalable in each fiscal year, excepting years in which all underutilized technology applications have been processed, and applications remail unfunded with funding still available in the set-aside.

- The scoring rubric has also been updated.

Eligibility

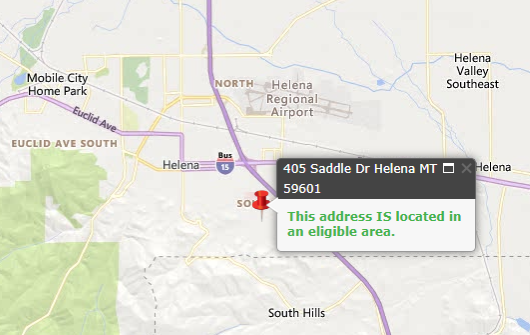

First, we need to determine if the customer is eligible to apply for the program. There are two criteria for eligibility – they have to be either an agricultural producer with at least 50% of their gross income coming from agricultural operations or a small business in an eligible rural area, which is defined as an area with a population of 50,000 or less. The USDA has a great online map to help determine if the project location qualifies, and there are far more eligible areas than you might think.

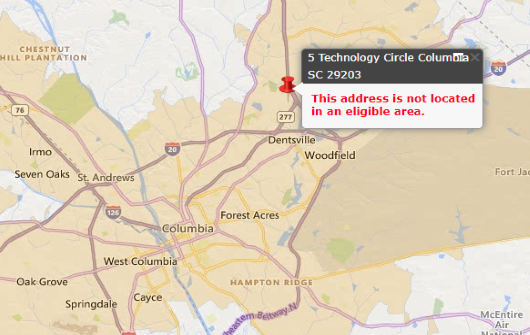

The project address of our small business customer is 405 Saddle Drive in Helena, Montana 59601. Plug that address into the map search and we see it is in an eligible area. If it is not eligible, it will have a light orange overlay on the map, and the comment box will indicate it is not in an eligible area. We used Colite Technologies at 5 Technology Circle in Columbia, SC 29203 as a comparison example.

Once we know the project is eligible, we move on to the application.

Application

Like many government programs, the application process for REAP requires various documentation and time to compile it all together. However, being prepared with the necessary information can make this process go much more smoothly. Be ready with:

- Business information – SAM (System for Award Management) company registration and a Unique Entity ID, profit and loss statements, EIN/TIN, W-9

- Project information – total costs, electrical design, expected energy production, contractors you plan to work with, project location map, knowledge of system equipment

- 12 months of historical energy usage at the location, including energy costs and/or utility bills

Also consider the environmental and community impacts of this project. Are there any:

- Potential threats to nature (endangered wildlife, trees, wetlands, coastal areas, hazardous materials, etc)

- Historical places and preservation requirements

- Environmental controversies

SAM registration is required to apply for REAP – pre–register the business in SAM before applying, as registration may take a long time to complete.

Your solar EPC should be able to support you with the project information portions and provide insight into any anticipated environmental impacts. When the application is complete, it will be submitted to the local USDA Rural Development office in your state. After the application has been reviewed and selected for funding, the office will notify you of the amount they intend to grant for the project. For our customer in Montana, the REAP grant amounted to about 25% of the total project costs.

There are a couple more documents to sign and then we proceed to installation. The funds will be distributed after the project is constructed, installed, and operating steadily for at least 30 days.

Installation

Project installation is not restricted by REAP. Coordinate with your solar EPC, installer, and any other contractors to get the project installed properly and interconnected to the utility grid in a timely manner. Each authority having jurisdiction (AHJ) works differently and has their own process, so be sure to follow the appropriate steps for your specific AHJ.

After installation, complete the documents certifying that the renewable energy system has been installed and is operating as expected within 90 days of system installation. Include a brief summary of the installation process and any recommendations for future applicants of REAP. Then, submit them to your state Rural Development office for processing.

Award

Once everything is reviewed and accepted, the state office will notify you of the final grant award amount. It will be sent via electronic payment to the account you specified on the application. The only thing that remains to be completed after receiving the funds is the post installation production report; it is usually due a year after installation to show 12 months of energy production. The report requirements depend on the type and size of the project and will be clarified in the Letter of Conditions document received with the grant intent.

For this project in Montana, the REAP grant covered almost all the costs to replace the old existing shingle roof with a new standing seam roof on the south-facing building. The standing seam roof is guaranteed to be leak-proof as it allows for the use of non-penetrative clamps to secure the solar system to the roof. Additionally, the clamps are a better attachment option in this region with large weather fluctuations throughout the seasons, and there is no doubt that the roof can support the system for its 25-year life without issue.

Impact

Incentive programs like REAP can substantially improve the financial attractiveness of commercial solar projects and encourage more businesses to install solar at their facilities. Combined with other federal and state tax credits, bonus accelerated depreciation, and instant energy savings, the economics of solar begin to look incredibly appealing.

Our customer was also eligible for a net metering program with their electric utility, Northwestern Energy. Along with the 55% direct energy offset from the solar system, they will receive utility bill credits for excess energy not consumed. Once all grants, tax credits, and energy savings have been accounted for, the internal rate of return on this project is an excellent 19%.

Tell us about your project!

Colite Technologies can help you find available incentive programs that apply to your project, just like this one. Our team is dedicated to maximizing the value of solar for every customer.