The energy industry’s attention has been laser focused on the Inflation Reduction Act of 2022 for the last several months. With the president’s signature on August 16, the Act is now law and will invest historic amounts of resources into clean energy and emissions-reducing technologies. Just a week and a half later, we are already seeing a flurry of activity around new renewable energy projects and the revival of old projects.

US Greenhouse Gas Emissions Drop

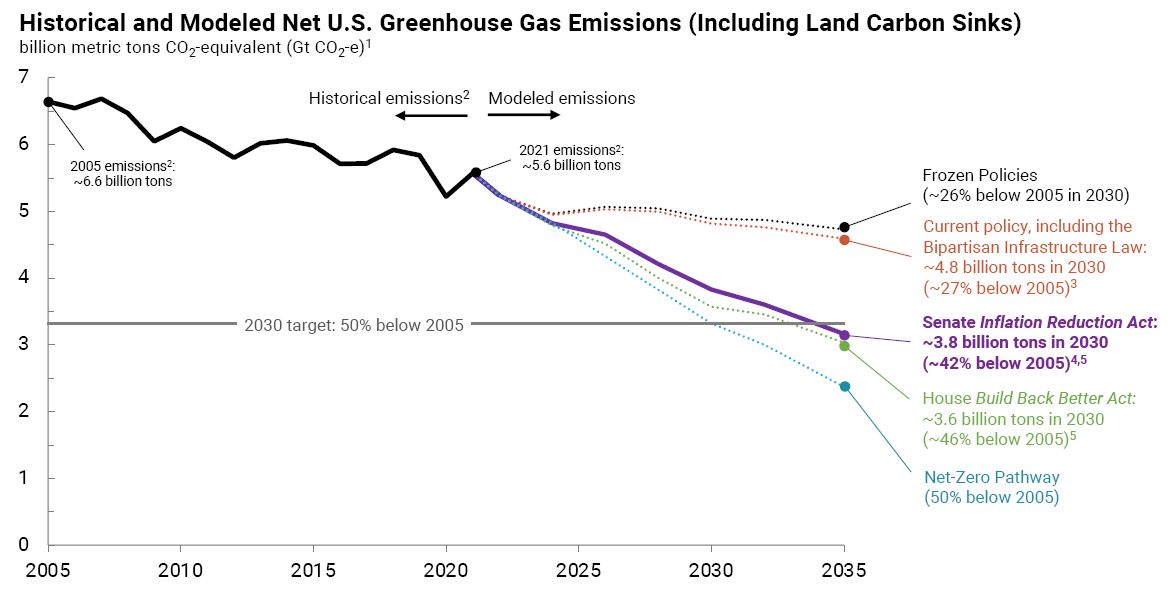

Princeton University’s REPEAT Project estimates that the Inflation Reduction Act (IRA) would decrease greenhouse gas emissions by about 1.8 billion tons – from around 5.6 billion tons in 2021 to around 3.8 billion tons in 2030. This brings the US to nearly 42% below 2005 emissions levels in 2030, not quite reaching the 2030 target of 50% below 2005 levels.

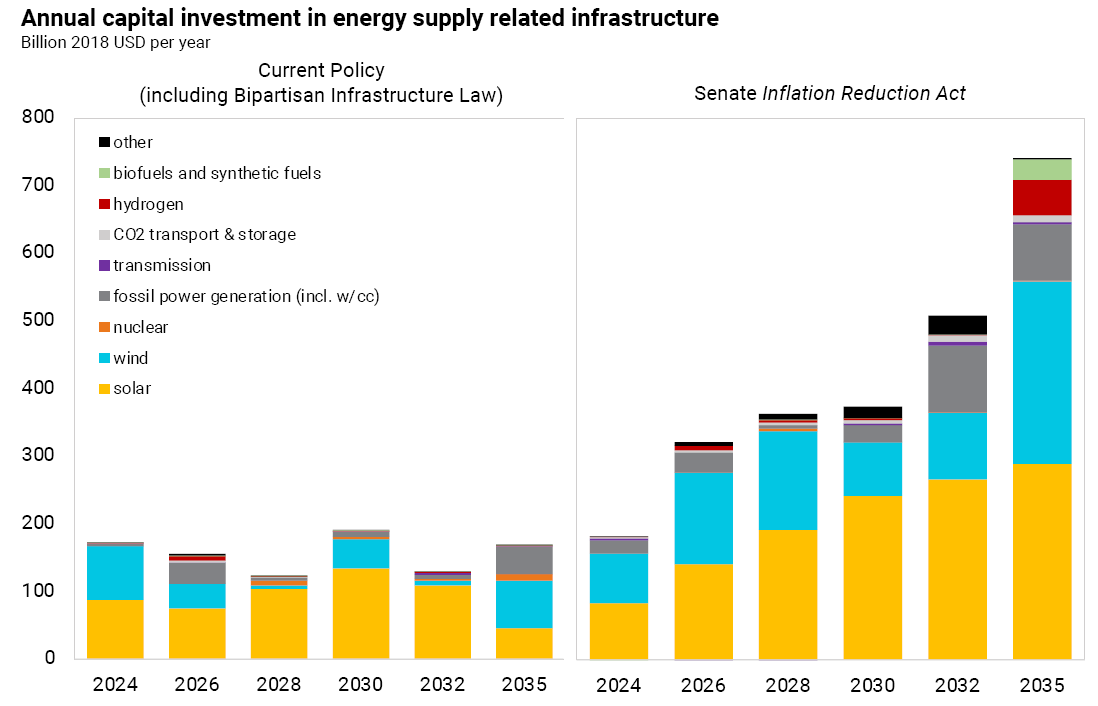

Much of this reduction is due to the significant boost in solar and wind capacity expected as a result of the IRA. Solar is slated to jump from 10GW of solar PV (utility-scale) in 2020 to an average of 49GW per year in 2025, about five times the 2020 pace with growth rates increasing thereafter. Wind capacity additions totaled 15GW in 2020 and are predicted to increase to 39GW/year in 2025, about two times the pace of 2020. (pg. 11)

Further, enhancement of the 45Q tax credit will incentivize the deployment of carbon capture at natural gas and coal power plants, decreasing greenhouse gas emissions from some of the most polluting industries.

Clean Energy Investment

In parallel to the capacity additions, the capital investment in new energy supply infrastructure will reach nearly $3.5 trillion over the next decade. Specifically looking at solar PV and wind, investment would double to $321 billion in 2030 versus $177 billion under policy pre-IRA. The act also includes “tens of billions of dollars in grants, tax credits, and loan programs to develop manufacturing and supply chains for clean energy components, batteries, electric vehicles and critical minerals.” (pg. 12) The buildout of manufacturing and supply chains will support job creation and skilled labor development in communities across the US – creating a domino effect increasing investment in adjacent industries.

Tax Credit Extension and Flexibility

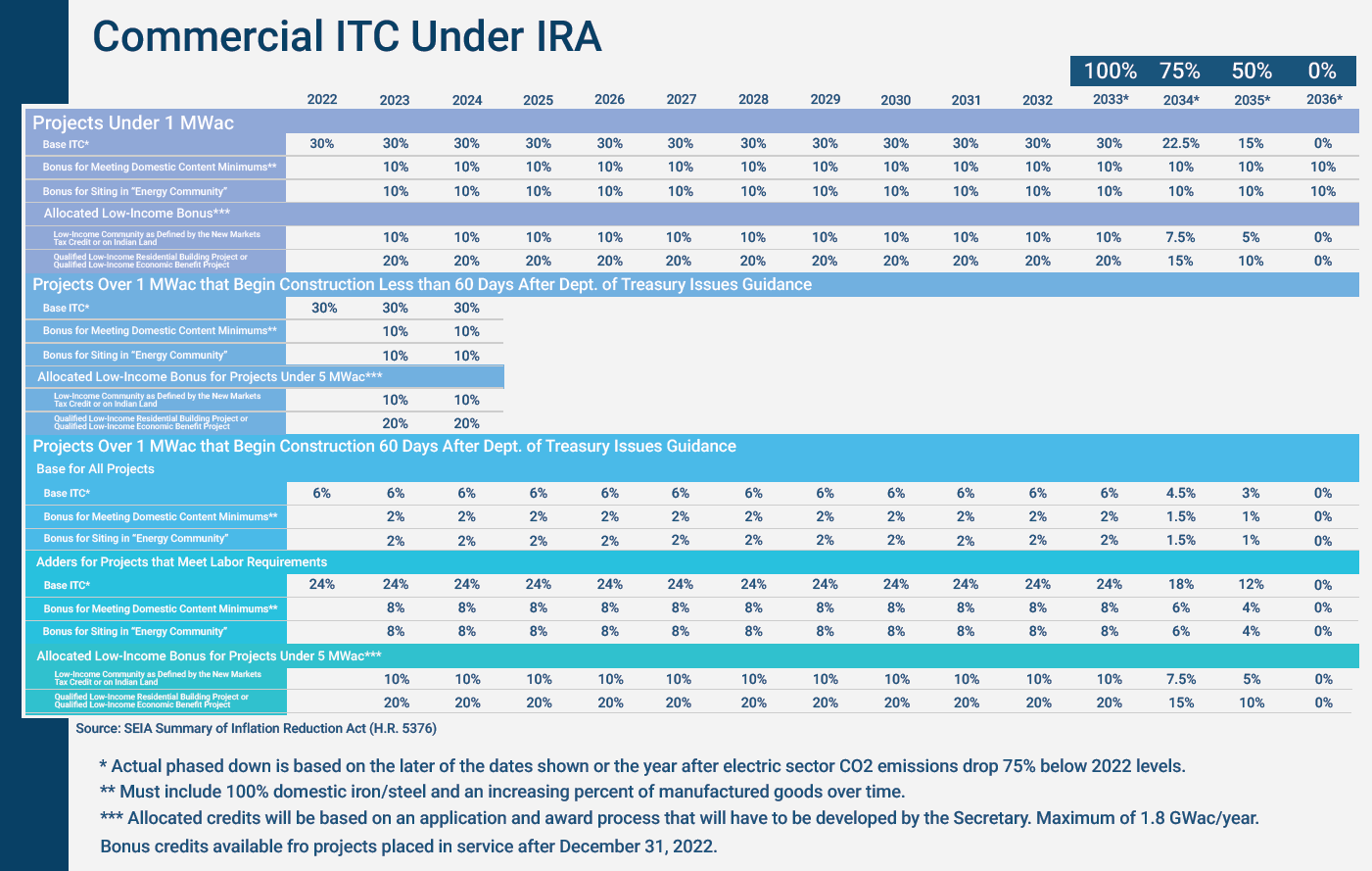

Perhaps the most pertinent change affecting renewable energy deployment is the extension of the business Investment Tax Credit (ITC) and added flexibility for credit eligibility. (This summary comes from SEIA Inflation Reduction Act Summary) For commercial and industrial energy users, the ITC is one of the major incentivizing factors for solar projects. The tax credit will be increased to 30% from 26% currently for projects that have started or start construction before the end of 2024. It then continues at the 30% rate until 2032, then phases down to 0% in 2036. The ITC also becomes available for interconnection costs if the project is less than 5MW ac.

There are bonuses to the base ITC depending on the size of project and if they meet certain criteria. The chart below details the tax rates by project size.

For projects under 1MW ac, businesses can add the following bonuses in addition to the 30% ITC:

- +10% for meeting domestic content minimums

- +10% for projects sited in energy communities

- +20% for projects in qualified low-income communities or on Indian land

There is also a provision that makes state and tribal governments, Alaska native corporations, certain tax-exempt entities, and rural cooperatives eligible for direct pay. This enables entities without tax liability to receive the incentive as a cash payment. With direct pay, many of the nonprofits, schools, and governments that desired renewable energy systems but couldn’t make the investment can reevaluate their position.

Lastly, the ITC can now be transferred. The entity receiving the tax credit can transfer the amount to another entity once, helping system owners decrease the cost of their investment. This is especially useful for situations where a business wants to install a solar PV system, or other renewable energy system, but does not own the property. The tax credit can be transferred from the property owner to the business, and the business receives the full benefits of switching to sustainable energy.

The IRA brings a lot of good changes to the clean energy industry and makes clean energy more accessible to a greater number of people. Particularly for commercial and industrial customers, the 30% ITC expansion and ability to transfer the credit offers a significant boost to getting more renewable energy systems installed at the point of use. Furthermore, the direct pay provision opens new avenues for non-taxed entities, governments, and rural co-ops to participate in the energy transition as well.

Colite Technologies’ goal is to get you the best value for your renewable energy project. We research, analyze, and model different systems based on your specific power needs to maximize your return on investment. Talk to one of our team members to take advantage of these credits today!