Overcoming Barriers to Growth in the Commercial Solar Market

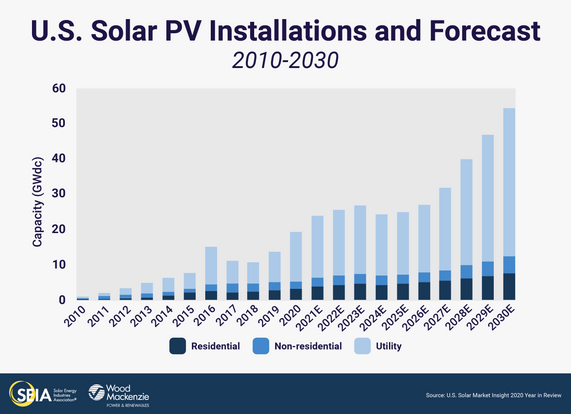

The last 18 months have seen major challenges for the US economy: businesses have shut down, supply chains have been considerably strained, material inflation is through the roof, and workers are scarcer than they’ve been in decades. Amid all this turmoil and disruption, the U.S. solar market found a way to continue its upward momentum setting a new annual record with 19.2 GW installed in 2020. A strong pace of growth is expected to continue achieving record new solar installations each year at least until 2024, when current incentives will sunset. However, even with the tremendous growth that continues in the industry, the commercial market segment has lagged considerably behind.

The commercial solar market segment is difficult to define, ranging from customers that include non-profits, universities, local schools, to small local businesses, and large corporations. They come in many different shapes and sizes and have differing economic drivers. According to Wood Mackenzie only about 3.5% of all commercial buildings in the US have solar and another 1% can be accounted for through community solar subscriptions, where customers buy power from a solar project located in the same utility territory. Despite this low number, solar systems could qualify as a worthwhile investment on approximately 70% of commercial buildings in the US. That equates to over 600,000 sites and 145 gigawatts (GW) of solar capacity potential.

Financing Barriers

Several factors have inhibited this market segment from reaching its full potential, one of which is inefficient and costly project financing. While there are good third-party financing options available for commercial solar – including power purchase agreements (PPA), operating leases, and property assessed clean energy (PACE) programs – each commercial solar project has a high degree of customization and complexity. Additionally, any of these financial structures require investors that can take advantage of key tax incentives such as the investment tax credit (ITC) and accelerated depreciation benefits. The capital needed to monetize these tax benefits is often referred to as tax equity, which can also be laced with more complexity and uncertainty. These complicated hurdles tend to scare off potential investors and too often prevent commercial solar projects from getting off the ground.

As stated, commercial solar projects are often customized to each customer; finding documents and agreements that could be standardized by customer type or system size can greatly simplify transactions and reduce costs for both parties. It speeds up negotiations and investors are more likely to pursue partnerships with developers that have standardization. It can also demonstrate that the developer is able to consistently and efficiently put together projects with the right equipment and off takers, building confidence with the investor.

Alternatively, for-profit commercial property owners can elect to self-finance solar projects by tapping directly into benefits from a patchwork of federal, state, and local incentives. However, this can also be cumbersome to piece together. For example, non-taxable state rebates can reduce the basis of the federal ITC, reducing the total amount of ITC received, or can be overly complex to administer, such as requiring an owner to register for and trade renewable energy certificates or RECs. Additionally, these attributes may not benefit all owners equally, i.e. an owner must have sufficient tax liability to capture the full value of the credits and bonus depreciation. Working with a competent and experienced developer can add clarity to these benefits and help maximize project ROI.

Owner-Tenant Objectives

Another factor that inhibits growth in the commercial market segment is when owner and tenant objectives are not fully aligned. The easiest transaction occurs when the owner occupies the building and pays directly for the utility costs. It gets more complicated when the owner leases to a third-party tenant. In this situation, the tenant typically pays rent plus all additional expenses including utilities. The owner may have an interest in solar, but the tenant controls the electric meter and pays directly for electricity. Therefore, the landlord has little incentive to invest if the electricity costs savings accrue only to the tenant. A solution would be for the landlord to own the solar system and sell the electricity to the tenant, or to include a lease cost in the common area maintenance (CAM) for the property. If the lease term is long enough, another option would be for the tenant to buy the solar system, but the landlord may have concerns about installing solar on their roof.

In each of these scenarios, creative financing structures can allow for solar and produce incremental benefits for both landlord and tenants. On one hand, solar energy offers commercial property owners and managers an exceptional opportunity to boost cash flow and property value by reducing utility expenditures, increasing rents, or increasing common areas maintenance (CAM) reimbursements. On the other hand, tenants can generate value from lower utility expenses and a greener building portfolio.

While there have been, and will continue to be, challenges in deploying solar in commercial markets, new models for managing transactions and continued falling price of the technology point to a much brighter future. Giving commercial property owners and managers the ability to control energy costs and reduce tax liabilities while also achieving ambitious sustainability goals will make commercial solar increasingly attractive. Directly addressing these key challenges in financing and expanding solar capacity in the commercial segment can bring the ambitious clean energy goals set by the industry closer within reach. The ongoing combination of private sector innovation and all of us pushing for stable, long-term public policy will set the solar industry on a path to achieving aggressive goals to address climate change and decarbonize the economy.