SRECs: Explained

The renewable energy industry loves its acronyms. From PV to kW to EPA, there are so many different acronyms to keep up with. Maybe you’ve seen SREC floating around recently. SREC stands for Solar Renewable Energy Certificate (or Credit) and is a great tool to encourage more solar energy use. This blog post digs into SRECs and gives a general overview of how they work.

We have provided this list of acronyms used in this blog for convenience:

REC – Renewable Energy Certificate (or Credit)

SREC – Solar Renewable Energy Certificate

RPS – Renewable Portfolio Standard

ACP – Alternative Compliance Payment

PJM – regional transmission organization (RTO) that coordinates the movement of wholesale electricity in all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia

WREGIS – Western Renewable Energy Generation Information System

What is an SREC

If you have a system that generates electricity from renewable energy, you can get one credit for every one MWh of electricity produced by that system. These credits are representative of the sustainable nature of the electricity and are not related to the monetary value of the physical electricity (i.e. if you’re selling electricity back to the grid, the REC has no impact on that price). The RECs can be sold to others and used to meet renewable energy procurement goals and standards. RECs can be earned from electricity produced by renewable energy such as hydroelectric, solar, or wind. SRECs are a specific type of REC, signifying that the electricity was generated by solar energy, and is the most common type of REC.

SRECs are most often paired with state Renewable Portfolio Standards (RPS). An RPS outlines that a certain amount of the state’s energy portfolio must be met with renewable energy. If there is a specified portion of the RPS that is reserved for solar, then that portion is called a “solar carve out.” Since the US electric grid is based on a centralized distribution system, the electric utility companies are responsible for sourcing more renewable energy to generate the electricity that is delivered to individual consumers. As a result of the solar carve outs, utilities are focusing on building their own PV systems or obtaining SRECs from others.

Now you may think, what is motivating the utilities to buy SRECs? Is there a penalty for not meeting the RPS? The answer is yes – utilities will be subject to Alternative Compliance Payments (ACP) if they do not meet their state’s RPS. These payments are generally set higher than the cost of an SREC to incentivize utilities to procure solar energy; otherwise, their option is to pay the ACP.

The prices of SRECs are determined by supply and demand in the market and the price of the ACP. Each state has its own requirements for certification and which credits can be traded in the market. Most states have an individual market and people with systems located in the PJM territory can participate in the Pennsylvania market. The ACP is set by each state and acts as a price ceiling for the SREC. Therefore, we see market prices of SRECs in Massachusetts around $300 to $400 due to high demand, but in Ohio, the market prices are closer to $15 due to a surplus of SRECs in that market. You can explore current market prices of SRECs on the SRECTrade website.

Available Markets

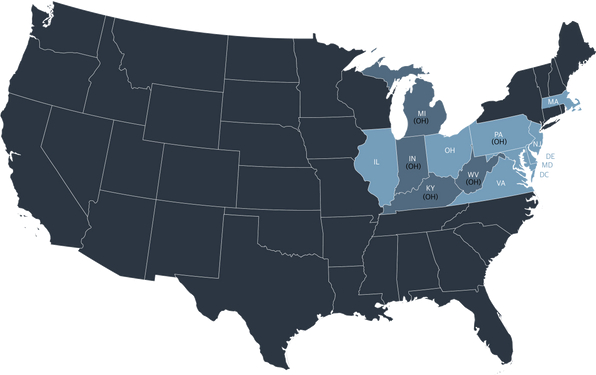

SRECs and solar carve outs are a great way to spur greater renewable energy adoption. However, only a handful of states have SRECs and a market to trade them, as seen on the maps below. The two main areas that participate in SREC markets are on the east coast and west coast of the United States.

East coast market map (SRECTrade.com)

Massachusetts, New Jersey, Maryland, Washington D.C., Virginia, Delaware, Illinois, Pennsylvania, and Ohio all have their own SREC markets. Pennsylvania and Ohio have special provisions for their markets – all solar systems interconnected in PJM territory are eligible for the PA Tier 1 REC Market and systems located in Pennsylvania, Michigan, Indiana, Kentucky, and West Virginia are eligible for the Ohio market. The Ohio market is particularly beneficial for Michigan, Indiana, Kentucky, and West Virginia because these states do not have their own SREC market, thus the people in this area can still receive the benefits of SRECs.

On the other end of the US, there is the Western Renewable Energy Generation Information System (WREGIS) that tracks RECs in the Western Interconnection territory. WREGIS is different from an SREC market because it simply certifies and tracks the RECs but does not trade them – trading occurs in individual markets much like the east coast. WREGIS serves energy providers in Alberta and British Columbia provinces in Canada, 14 western US states, and Northern Baja California in Mexico.

WREGIS map (wecc.org/WREGIS

Benefits

The trade of renewable energy credits is a beneficial system for both parties. The person earning the SRECs can use the money received from the sale to offset the investment they made into the generation system. Once the investment is recouped, they can continue to sell credits as long as the system produces 1MWh. The entity buying the SRECs can count these credits toward their own sustainability goals even if they don’t own a system themselves. It helps utilities and companies reach carbon reduction goals faster, especially those that are under fierce pressure from the state level to decarbonize. It also allows those in geographies with limited renewable energy resources to be a part of the sustainable transition.

Furthermore, SRECs push more solar energy deployment as a whole and support the solar industry which, over time, brings material costs down, strengthens the workforce, and encourages advancement in PV technologies. Greater solar energy use leads to less harmful greenhouse gas emissions for the natural environment and diversifies our energy mix. Should a state be interested in creating their own SREC market, existing markets can provide a framework for legislators to model.

Limitations

You may wonder, wouldn’t SRECs be double counting sustainable energy production? No, because if you sell the SREC, you can’t count that energy production toward your individual energy offset and subsequent carbon offset. The person buying the credit owns that claim now. Think of it as a common goods transaction – you provide the goods that another person purchases to use for themself. So, the utility is paying you to generate the solar energy that they will use to meet their clean energy goal.

Perhaps the most significant limitation is the fact that SRECs are not widely available in the US. The solar system must be located in select areas to be eligible to participate in a market and depending on the supply and demand of SRECs in that market, prices vary significantly. Because there is no national market, system owners are constrained by their location on what prices they can sell their SRECs for. Additionally, people in states without SRECs are missing out completely. A national market could offer an accessible, standardized market for everyone in the US and help accelerate sustainable energy adoption in less high-profile areas.

However, even without SRECs, renewable energy systems are a good long-term investment. Producing your own clean energy onsite can offset a considerable amount of your current energy use, offering greater energy independence and easing the strain on the existing electrical grid. Annual energy savings paired with lower risk of power outages help commercial and industrial facilities operate much more efficiently. As a bonus, most systems are also eligible for renewable energy tax credits and incentives. Combine those benefits with the overall trend of lower component costs and improving technology, renewable energy systems will continue to be an economical alternative to traditional energy generation.