Alternative Lending Solutions for Small and Rural Businesses

Are you missing out on potentially game-changing financing opportunities?

Over the past two decades, US companies have witnessed record setting volatility in the market, creating anxiety amongst investors and business owners alike. Particularly hard hit are the rural and underdeveloped regions where direct investment and lending opportunities are scarce for a multitude of reasons. Fortunately, the creation of federally secured small business loans, grant programs, and opportunity zones have provided cash-strapped and over-leveraged businesses an opportunity to renovate and upgrade their facilities without the burden of large expenditures or up-front costs.

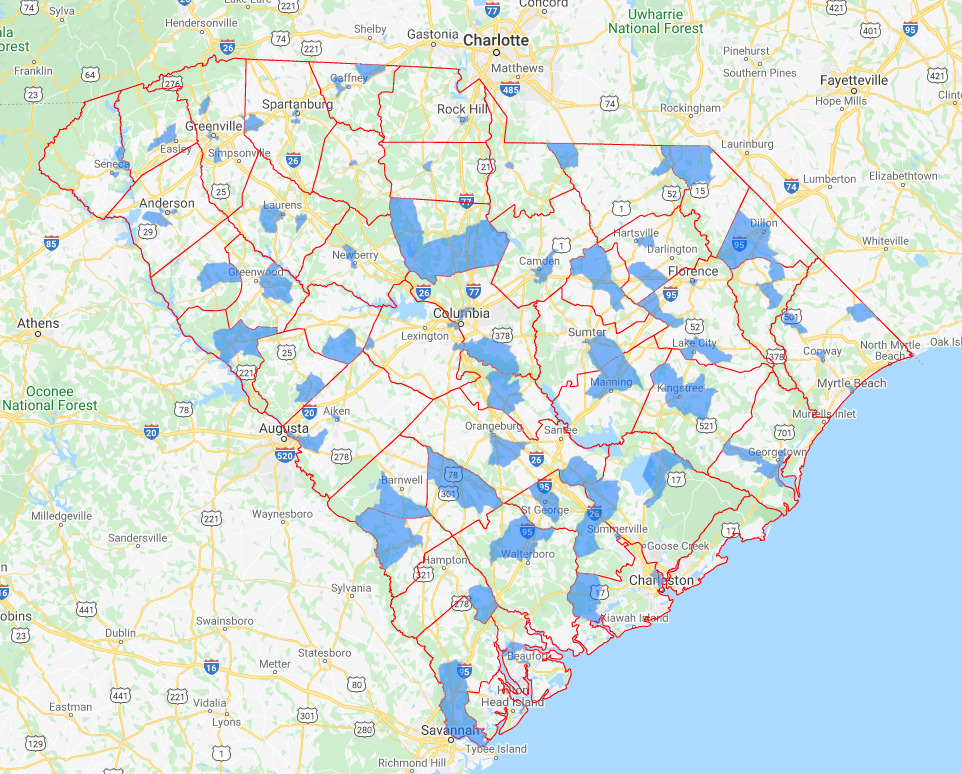

Opportunity Zones

The Tax Cuts and Jobs Act of 2017 established Opportunity Zones as a community investment tool to spur long-term private-sector investments in low-income communities nationwide. Opportunity Zones (OZ) are low income census tracts nominated by governors and certified by the U.S. Department of the Treasury into which investors can use capital to finance new projects and enterprises in exchange for certain federal capital gains tax advantages. This program provides participating entities a financial incentive to invest the necessary funding for commercial and industrial scale renewable energy projects.

First, a qualified lender—defined as a corporation, limited liability company, or individual—establishes an investment vehicle with the sole purpose of holding the opportunity zone property. This vehicle is required to hold 90% of the fund’s assets. The eligible fund will now determine which of the three tax incentives best fits their lending model.

The program offers three options, a temporary deferral, a step up in basis, and a permanent exclusion.

- A temporary deferral of inclusion in taxable income allows for the gains to be reinvested into a fund but must be recognized and disposed of by the end of 2026.

- The step up in basis allows for a 10% increase in basis if the investment is held for at least 5 years, with an additional 5% increase if held for at least 7 years.

- The capital gains from the investment in the opportunity zone may also be permanently excluded if held for at least 10 years.Opportunity zones offer a unique investment option and provide additional value to investors and business owners. Combined with tax incentives and decreased operating costs of renewable energy systems, these options can help business owners face the challenge of continually escalating energy prices.

Opportunity zones offer a unique investment option and provide additional value to investors and business owners. Combined with tax incentives and decreased operating costs of renewable energy systems, these options can help business owners face the challenge of continually escalating energy prices.

USDA – Rural Energy for America Program

Here in South Carolina, our rural businesses struggle to compete in an evolving global economy and political atmosphere while simultaneously juggling the stress of maintaining production schedules and facility upgrades. Luckily, the US Department of Agriculture offers guaranteed loan financing and grant funding to agricultural producers and rural small businesses to encourage energy independence through renewable energy and energy efficiency upgrades. This program is known as REAP, the Rural Energy for America Program.

Qualifying agricultural producers and small businesses can receive loan guarantees on loans up to 75% of total eligible project costs, grants for up to 25% of total eligible project costs, or a combined grant and loan guarantee funding up to 75% of total eligible project costs. The funds can be used for renewable energy systems such as solar, wind, hydropower, biomass, and geothermal generation, and energy efficiency improvements such as lighting, insulation, HVAC systems, irrigation, and doors and windows.

With payment terms of up to 30 years and grants of up to $500,000, a credit heavy industry such as commercial agriculture will not have to worry about damaging their current debt relationships and obligations. Additionally, they can get the necessary capital to make smart energy upgrades, which lowers operating costs and frees up capital to invest in other parts of the business.

Coupled with greater energy independence and reduced energy costs, the REAP program helps rural business owners efficiently allocate their limited resources and generate value that will enable them to succeed in a challenging economic environment. These initiatives boost the small players to opportunities that otherwise would have been out of reach.

As we continue forward into an unpredictable and uncertain future, our disadvantaged businesses will require new and innovative financing methods to succeed in a global economy. Thanks to the support of our local, state, and federal agencies, programs such as the Opportunity Zones and REAP offer incentives that benefit those businesses and the communities that they serve.

For more information on these programs, please visit these resources:

Rural Energy for America Program